Tax Exemption RequestUpdated a year ago

Overview

On occasion, individual customers will request a refund of taxes paid on an order due to the furnishing of a tax exemption certificate. Either the customer is ordering on behalf of the government, is a diplomat, or is a part of a tax-exempt university.

These refunds are typically processed in CyberSource. However, with the Tango Bravo rollout, it’s important to ensure we are properly reflecting these refunds in NetSuite, so it rolls up into Avalara. Therefore, the following SOP has been created to ensure this process works.

- Request approval from tax. Without approval from the tax department, no tax refund can be processed at any time. See example below of a typical approval flow:

- Recalculate Taxes in NetSuite: Please search for the cash sale by the order number. In the example above, you can see the order number corresponds to the following cash sale:

- Review status of cash sale to determine whether the tax can be recalculated on the cash sale. If the status is “Deposited” then the tax cannot be recalculated. See image below:

In that instance, a manual refund will need to be processed for the sales tax.

If the status of the cash sale said “undeposited” then we can go ahead and recalculate the taxes as shown below (in a hypothetical scenario):

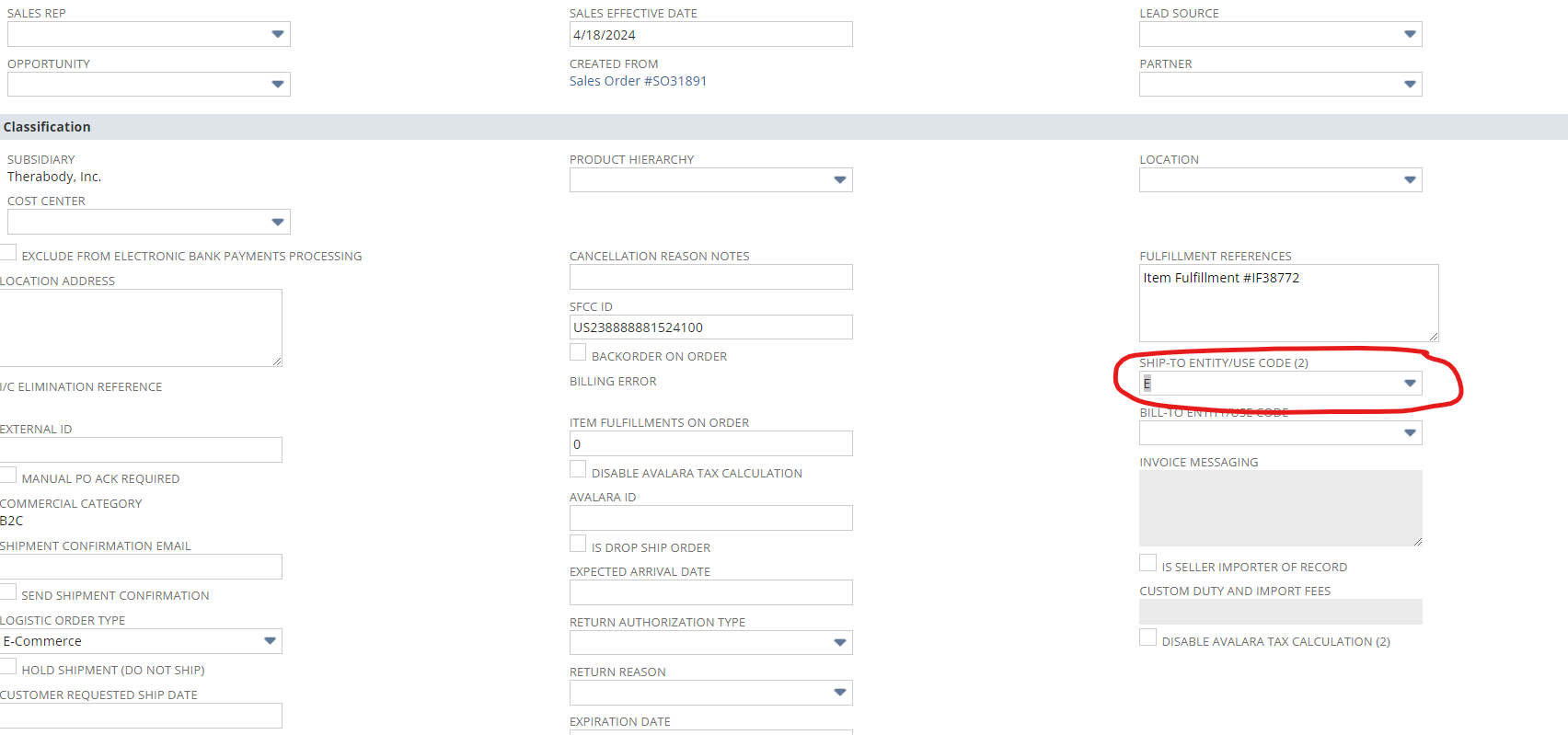

- Press the “Edit” button to edit the cash sale. From there, scroll down to the section labeled "classification" and search for the drop-down box called "ship-to entity/use code (2)." When selecting the drop down options, select the letter "E" (see image above)

- From there, scroll down to the section below the word "items" and disable "tax amount override." See image below:

- Once done, scroll all the way up and press the "calculate" tax button. You will now see the tax of $24.68 revert to 0. See image below:

- Once done, press save and the cash sale should recalculate.